Introduction

Many small and medium enterprises (SMEs) in the Northern Cape and Limpopo face significant challenges accessing funding, market opportunities, and essential business development support. Without these resources, SMEs struggle to scale, create jobs, and contribute meaningfully to local economic growth. Traditional financing solutions often exclude these businesses, limiting their ability to fulfil purchase orders and grow their operations. This lack of access to critical support perpetuates economic disparities within the SIOC-CDT beneficiary communities and constrains regional socio-economic development.

The first phase of the programme closes on 29 November 2024. The programme will then be reviewed with plans for a second phase to be unveiled in the second quarter of 2025.

The way it works

The Growth Fund offers:

- Short-term funding of R250,000 to R2 million to SMEs in beneficiary areas at zero fees and interest for up to 120 days. This enables SMEs to fulfil purchase orders from large corporates and government entities, with payment remittance through an escrow account to ensure funds are recovered and redistributed for ongoing support.

- The enabling of local sourcing and credible supplier selection.

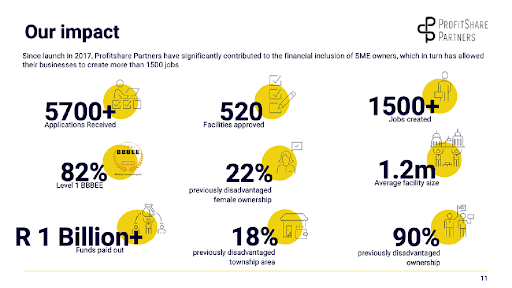

- Collaborations with partners such as the Small Enterprise Development Agency (SEDA), the National Youth Development Agency (NYDA), and ProfitShare Partners (PSP) to broaden market access and offer trade finance solutions, helping underserved SMEs grow their customer base.

- Regular mentorship, training in financial management, governance, health and safety, and marketing, along with monthly site visits, to ensure that SMEs receive the skills and guidance necessary for sustainable growth. Additionally, a steering committee oversees programme implementation and progress.

- Awareness and community engagement through events such as the Travelling Mine Expo, raising awareness of the Growth Fund and its benefits whilst fostering direct engagement with local business owners and stakeholders.

Partners

The Growth Fund’s partner portal allows real-time access to applications and supports SME onboarding, further streamlining the funding process and expanding its reach within the beneficiary communities.

The results

The Growth Fund has allocated R6.52 million to support transactions within SIOC-CDT beneficiary areas, enabling SMEs to fulfil purchase orders and driving revenue growth of 129% across the portfolio. The verification process for purchase orders has strengthened clients’ understanding of supply chains and supplier credibility, building their readiness for future opportunities and enhancing financial resilience.

To date, 17 SMEs have benefited from the Growth Fund, with six transactions fully completed and repaid. SMEs supported by the Growth Fund have reported substantial revenue growth and an expanded pipeline of opportunities, demonstrating the programme’s impact on local economic development.

Clients have returned to seek additional funding to expand their operations.

Registrations for the Growth Fund have surged by 120% due to successful marketing efforts, with 275 individuals registering to engage with the fund.